The global solar inverter market will contract for two consecutive years, declining 2% to 577 GWAC in 2025 and a further 9% to 523 GWAC in 2026, according to Wood Mackenzie’s latest reporting. The downturn follows record shipments in 2024 and reflects market uncertainty across major regions including China, Europe and the United States.

“The solar inverter industry faces a period of strategic realignment as manufacturers navigate evolving market dynamics and regulatory frameworks” said Joe Shangraw, research analyst at Wood Mackenzie. “After years of an exponential rise in solar inverter demand, continuous shipment growth is no longer realistic for even the top global inverter manufacturers. Instead, vendors will need to adapt to new demand drivers to stay competitive: hybrid solar-plus-storage systems, retrofits and repowering, cybersecurity features, 2000-V architectures, and grid services.”

U.S. inverter market prepares for volatility

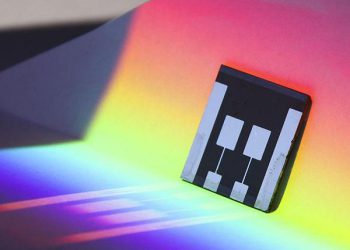

Credit: Titan Solar Power

The U.S. market is experiencing policy-driven volatility. WoodMac expects the U.S. market will reach 47 GWAC in 2025 before declining 22% in 2026 as Inflation Reduction Act tax credits are phased out.

Inverter pricing continues its downward trajectory across all product categories, driven primarily by Chinese manufacturing competition and technological advances. Module-level power electronics (MLPE) maintain significant regional price disparities. U.S. MLPE prices are over 50% higher than global averages, as market leaders Enphase and SolarEdge must compete against a growing number of Chinese vendors in Europe, Latin America and Asia-Pacific markets. Hybrid inverter prices also declined 13% in 2024 as DC-coupled battery-ready systems become standard offerings from manufacturers like Huawei, SolarEdge and Tesla. Utility-scale inverter pricing faces the steepest declines, with central standalone inverters approaching $0.01/WAC by 2034.

“Cybersecurity concerns over inverter remote-access capabilities are gaining significant traction in both U.S. and European governments, with stricter policies expected in 2026 that could impact the competitive landscape between domestic and foreign manufacturers,” Shangraw said. “We expect the two regions to follow different strategies to address cybersecurity concerns. Europe is expected to expand upon the Cyber Resilience Act by introducing additional software, reporting and remote-access requirements that could serve as economic or logistical barriers to foreign manufacturers. Meanwhile, Republican lawmakers in the U.S. are urging the Department of Commerce to implement restrictions on Chinese inverter imports, adding uncertainty to the roadmap for both foreign and domestic manufacturers.

“Following this current downturn, we do expect the solar inverter market to recover and even surpass the 2024 market size by the early 2030s,” Shangraw continued. “Electrification, AI demand growth and a cyclical repowering market will provide a solid foundation for inverter demand over the next decade. Companies that navigate the current challenges while investing in next-generation technologies will emerge stronger when the market recovers in the late 2020s.”

News item from Wood Mackenzie