Maryland has launched a powerful new incentive called the Maryland Commercial and Canopy Solar Program. This is a $13 million grant designed to significantly reduce the cost of commercial solar and accelerate solar adoption across the state. This program offers some of the highest solar incentives we’ve seen, with potential coverage up to 75% or 90% of a project’s cost for eligible businesses, farms, and nonprofits. If you’re exploring the Maryland Commercial Solar Grant for your organization, this guide breaks down everything you need to know: eligibility, benefits, the application process, timelines, and how Paradise Energy can help you secure this grant.

What Is the Maryland Commercial and Canopy Solar Program?

The Maryland Commercial Solar Grant is a state initiative with $13 million available to support solar projects in designated census tracts. Funding is limited and awarded on a first-come, first-served basis, making early action essential. Grant coverage is determined by organization type:

- For-profit businesses & agricultural producers: The lower of $1,700/kW or 75% of the total project cost (Carports and canopy installations may qualify for up to $2,125/kW)

- Nonprofits: The lower of $2,000/kW or 90% of the total project cost (Carports and canopy installations may qualify for up to $2,500/kW)

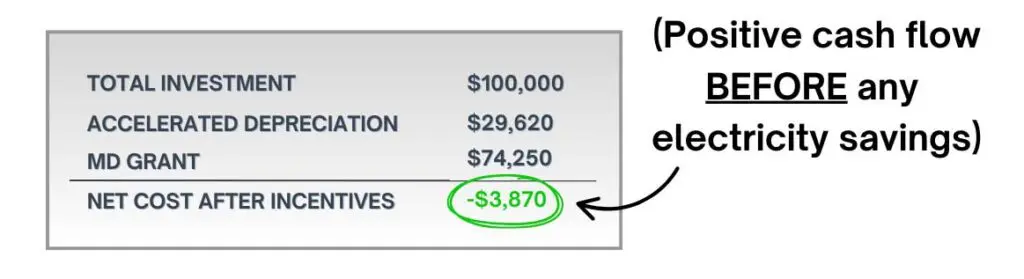

The maximum award per entity is $500,000. Here’s an example of what this could look like for you – a $100,000 commercial solar project using the grant and accelerated depreciation started $3,870 in the green, before any electricity savings!

Who Qualifies for the Maryland Commercial Solar Grant?

To receive funding from the Maryland Commercial and Canopy Solar Program, applicants must meet specific requirements: Eligible for the grant:

- Businesses, non-profits, and agricultural producers located within approved Maryland census tracts

- Organizations registered to do business in, and in good standing with, the State of Maryland

- Agricultural producers living on the farm where solar is installed

- Businesses willing to attest they can support the community during an outage (e.g., providing shelter or assistance)

Not eligible for the grant:

- Municipalities or towns (a separate program exists for them)

- Prior state grant recipients

If you’re unsure whether your building or farm qualifies, Paradise Energy can help verify your location’s eligibility.

How the Federal Tax Credit Impacts Your Maryland Grant Amount

The Maryland Commercial and Canopy Solar Program requires the federal Investment Tax Credit (ITC) to be removed from all project cost calculations. The ITC is considered an ineligible cost. What this means for applicants:

- You must subtract the federal ITC from the eligible grant coverage amount if you decide to utilize the tax credit.

- If an applicant receives the grant and later claims the tax credit, the state may recapture the grant funds.

- You can still utilize the accelerated depreciation tax benefits of commercial solar.

Important note: It will most likely work out that grant recipients will be in a stronger position if they do not take the tax credits. However, we encourage applicants to consult their accountant before making their final decision.

What You Need to Apply For The Grant

The application process for the Maryland Commercial Solar Grant is straightforward. To submit a complete application, you will need:

- 12 months of electric bills (or all bills if aggregating meters)

- Signed W9

- Proof of good standing in Maryland

- A preliminary one-line diagram (provided by Paradise Energy)

- Confirmation that you have the funds to proceed if awarded

Don’t worry, Paradise Energy will complete the grant application and submit it on your behalf.

When Will The Grant Funds Be Distributed to You?

While award decisions for this grant may be made within 10–12 weeks, funding is typically disbursed later. Historically, Maryland grant payouts occur 6–12 months after:

- The solar system is fully installed

- The utility has approved the system to operate

- The customer has paid for the system in full

Funds are issued directly to the customer, not the solar installation company.

How to Maximize Your Grant Funds

Because the grant calculation is based on the project size or total cost, certain strategies may help you maximize your awarded grant amount. Here are some things to consider:

- Simplifying the project by removing optional add-ons or “extras.”

- Including necessary service upgrades, which are generally allowable costs

- Not taking the federal tax credit

Our team can help you examine these scenarios to see the financial impact each option has on your grant eligibility and funding amount.

Why Now is the Best Time For Your Maryland Business to Go Solar

With limited funding available and strong demand expected, the Maryland Commercial Solar Grant funds are not expected to be available for long. We expect them to be quickly depleted. To find out if your business, farm, or nonprofit qualifies, contact the Paradise Energy team today. Here’s how we can help:

- Confirm whether your location is in an eligible census tract

- Estimate your potential grant amount

- Provide a solar proposal reflecting the Maryland grant, so you can see exactly what your payback will be

- Prepare your one-line diagram and required documentation, and then submit it on your behalf

- Successfully complete your solar installation to help you take control of a rising expense and protect your bottom line